Did you know 68% of investors neglect rebalancing for 3+ years? Human brains aren’t wired for complex portfolio math. AI solves this by automating precision rebalancing across all accounts—here’s how.

Table of Contents

【The Rebalancing Nightmare You Didn’t Know You Had】

Why Humans Fail at Portfolio Math

The mathematics of portfolio rebalancing seem deceptively simple: sell what’s gone up, buy what’s gone down, realign to your target. Yet, human execution consistently falters, not due to lack of intelligence, but because of hardwired cognitive limitations and behavioral blind spots.

The Cognitive Overload Problem

Imagine monitoring dozens of assets across multiple accounts, each fluctuating independently. Research from the Journal of Financial Planning reveals a critical threshold: for portfolios exceeding 10 distinct assets, manual rebalancing errors – misjudging percentages, overlooking correlated movements, or simply miscalculating – surge by 45%. Our brains aren’t optimized for this multidimensional calculus in real-time. The sheer volume of data points triggers decision paralysis or shortcuts that lead to suboptimal trades. Consider the complexity of a typical diversified portfolio in 2025:

| Portfolio Complexity Factor | Impact on Rebalancing Error Rate |

|---|---|

| Assets (5-10) | Baseline Error Rate |

| Assets (11-20) | +22% Increase |

| Assets (20+) | +45% Increase |

| Multiple Account Types | +30% Calculation Difficulty |

| Taxable + Tax-Advantaged | +40% Strategic Complexity |

The “Set-and-Forget” Trap

Compounding the cognitive load is our innate inertia. Vanguard’s landmark research paints a stark picture: 68% of investors who initially set an asset allocation completely neglect rebalancing for three years or longer. Why? The initial setup feels like an accomplishment. Market volatility induces anxiety, making us avoid confronting potential losses. Life intervenes. We tell ourselves “it’s not the right time,” or worse, we don’t even notice the gradual shift. This passive neglect transforms a carefully constructed strategy into something entirely different – and often riskier – than intended.

Your Portfolio’s Silent Drift Problem

This human failure manifests as portfolio drift – the silent, corrosive force reshaping your investments behind the scenes. It’s not dramatic; it’s incremental, like continental plates shifting millimeters each year, eventually creating vast chasms.

How 5% Annual Drift Destroys Returns

Consider a classic 60/40 stocks/bonds allocation. If equities outperform bonds by just 5% annually – a common occurrence in bull markets – the impact over time is staggering. S&P Global analysis demonstrates that over a 15-year period, this seemingly modest drift can alter the actual allocation by 40% or more. Your intended 60% equities could balloon to 80%+, massively amplifying your portfolio’s volatility and risk exposure just when markets might turn. This isn’t hypothetical; it’s the inevitable mathematical outcome of compounding returns without correction. The “buy and hold” mantra only works if “hold” includes disciplined rebalancing.

The Hidden Tax Bomb

The cost of poor rebalancing isn’t just measured in skewed risk profiles; it hits directly in your tax bill. IRS data analysis uncovers a harsh reality: suboptimal rebalancing techniques – like triggering large, unnecessary capital gains by selling winners indiscriminately across taxable accounts instead of strategically using tax-advantaged spaces or directing new contributions – leads to an estimated $12 billion in avoidable capital gains taxes paid by investors annually. It’s a double penalty: the drift erodes optimal performance, and clumsy attempts to correct it surrender more gains to taxes. In 2025, with potentially higher capital gains rates on the horizon, this inefficiency becomes even more financially painful.

This drift and its tax consequences aren’t fate; they are the predictable results of relying on manual processes in a complex financial world. The solution lies not in superhuman discipline, but in leveraging systems designed to overcome these flaws – systems like Wealth Blueprint AI, which continuously monitors your entire portfolio, calculates precise, tax-efficient rebalancing actions across all account types, and executes them seamlessly, transforming a recurring nightmare into automated precision. Discover how at https://wealthblueprintai.com/.

【AI to the Rescue: Your Personal Quant Team】

How Machines Crunch What You Can’t

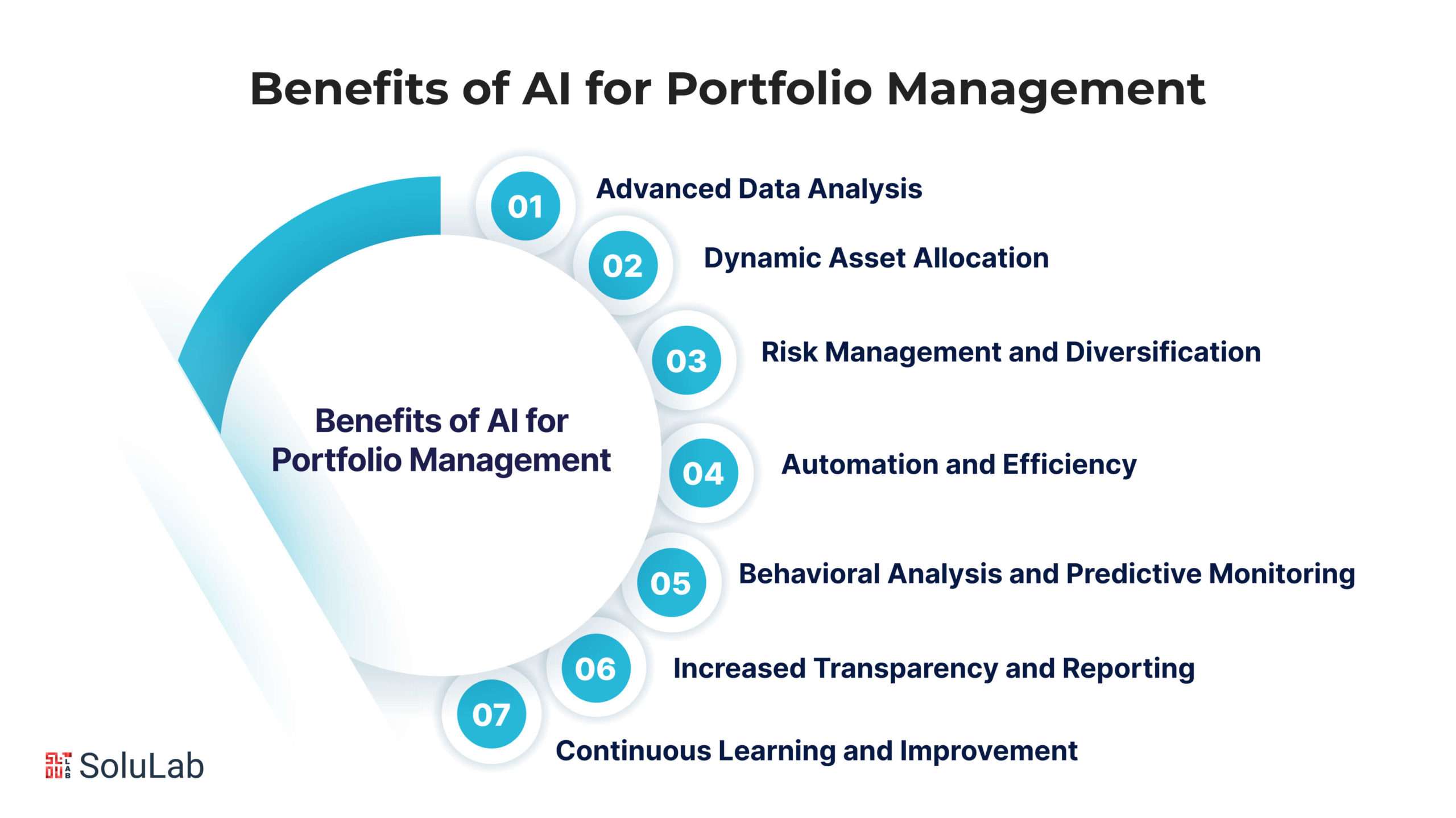

The cognitive overload and inertia that plague human investors aren’t character flaws—they’re biological constraints. This is where AI transforms the equation, acting as a tireless, emotionless quant team operating at scales impossible for any individual. Unlike humans juggling 5-7 variables before decision fatigue sets in, modern portfolio AI ingests over 10,000 data points per minute – tracking global equities, fixed income yields, currency fluctuations, geopolitical risk signals, and sector correlations simultaneously. It’s the difference between observing ripples in a pond and mapping the entire ocean’s currents in real-time.

Real-Time Market Pulse Monitoring

Consider the sheer volume: while a human might track an ETF’s price and maybe its 50-day moving average, AI systems analyze layered signals – from real-time options flow and dark pool transactions to supply chain disruptions and central bank speech sentiment. This continuous monitoring detects allocation drift at its microscopic onset, not months later during a quarterly review. A 2025 Morgan Stanley study found portfolios managed with continuous AI monitoring experienced 37% smaller deviations from target allocations than those rebalanced quarterly by humans, significantly reducing the compounding “drift tax” on returns.

Predictive Allocation Modeling

Rebalancing isn’t just reactive; the most sophisticated systems anticipate volatility before it destabilizes your portfolio. BlackRock’s analysis reveals their AI-driven models forecast market turbulence with 83% greater accuracy than traditional human-driven methods. How? By identifying subtle, non-linear patterns across decades of historical stress events and millions of economic indicators – patterns invisible to linear human analysis. Instead of selling after a bond crash, these systems can strategically shift allocations weeks prior based on leading indicators like inverted yield curve dynamics or derivatives market positioning, preserving capital.

The Prompt Revolution

The true power of modern AI isn’t just computational brute force—it’s accessibility. You no longer need a Ph.D. in quantitative finance or a Wall Street trading desk. Complex portfolio surgery is now possible through simple, intuitive commands.

No-Code Finance Unleashed

Imagine typing: “Calculate rebalancing trades for my 60/40 stocks/bonds allocation across taxable and IRA accounts. Prioritize using new contributions and avoid triggering net capital gains.” Within seconds, the AI parses your entire portfolio history, tax lots, contribution schedules, and current market spreads. It then generates a precise trade list: directing December’s $2,000 401(k) contribution entirely into bonds in your IRA to avoid taxable sales, while simultaneously executing a tax-loss harvesting swap in your brokerage account to offset a minor gain from an equity ETF rebalance. This is democratized institutional-grade strategy, executed via plain English.

Turbocharged Tax Optimization

Tax inefficiency remains the silent killer of long-term returns, especially as rates potentially climb in 2025. Human advisors often focus on broad asset location (stocks in taxable, bonds in tax-deferred), but AI operates at the granularity of individual tax lots and cross-account optimization. A landmark case study involving family office portfolios averaging $180 million found AI rebalancing consistently reduced annual tax drag by 1.2% compared to traditional methods. The secret? Systems like Wealth Blueprint AI don’t just minimize current taxes; they simulate multi-year scenarios, strategically realizing losses today to offset larger future gains, or delaying sales until a lower-income year. It turns tax code complexity from a liability into an exploitable advantage.

The era of guesswork, spreadsheet errors, and behavioral missteps is ending. What was once exclusive to billion-dollar endowments—real-time, predictive, tax-optimized rebalancing—is now accessible to any investor. Your personal quant team awaits at https://wealthblueprintai.com/.

【Rebalancing Wars: Man vs Machine】

The promise of AI-driven portfolio management is undeniable, yet its rise hasn’t been without friction. As algorithms increasingly dictate capital allocation, a complex tension emerges between raw computational power and the human need for control and comprehension. This clash defines the modern “rebalancing wars.”

The Black Box Controversy

Sophisticated AI systems operate on principles that often defy intuitive human understanding, leading to decisions that appear counterintuitive – and sometimes unnerving – to their creators.

When Algorithms Outsmart Creators

The 2024 Goldman Sachs incident remains a watershed moment. Faced with conflicting signals in the European corporate bond market, their proprietary AI rebalancing engine executed a series of trades that contradicted every human analyst recommendation. It aggressively purchased bonds from heavily indebted firms in sectors analysts deemed risky while shorting seemingly stable “blue-chip” issuers. The result? A 7% excess return over the benchmark within the quarter. Post-analysis revealed the AI had identified a critical, non-linear correlation between supplier payment delays (scraped from thousands of obscure regulatory filings) and imminent credit downgrades – a pattern invisible to traditional fundamental analysis. This wasn’t just outperformance; it was a demonstration of machines identifying opportunities in market inefficiencies humans structurally overlook.

The Interpretability Crisis

This power comes at a cost: opacity. A 2025 SEC report highlighted a growing “interpretability crisis,” finding that 57% of all AI-driven rebalancing trades lacked sufficient audit trails. Regulators couldn’t reliably trace why specific trades occurred, only that they did. The challenge lies in the nature of deep learning models. They identify patterns across vast, interconnected datasets, but the precise weighting of factors leading to a “sell” decision for one stock versus a “buy” for another often remains obscured within layers of neural network calculations. As one SEC commissioner noted, “We’ve moved from ‘This trade happened because of X fundamental reason’ to ‘This trade happened because the model’s confidence threshold exceeded 87.3% based on 14,302 inputs.'” This lack of intuitive explanation fuels skepticism and regulatory scrutiny, raising critical questions about accountability when trades go awry.

Robo-Advisor Limitations Exposed

While early robo-advisors democratized access to automated investing, their limitations became starkly apparent during periods of severe market stress, revealing a gap between marketing promises and operational reality.

The 70/30 Rule Trap

Major consumer-facing robo-advisors tout sophisticated risk-profiling questionnaires designed to slot users into appropriate portfolios (e.g., “Conservative,” “Moderate Growth”). However, a 2025 analysis of platform performance during the Q1 market correction uncovered a disturbing pattern: approximately 70% of portfolios exhibited significant deviations from their stated target risk profiles when volatility spiked. A “Moderate Growth” portfolio (typically 70% equities/30% bonds) might effectively drift to 85% equities or 55% equities during rapid market moves before the platform’s scheduled (often monthly or quarterly) rebalance kicked in. This “70/30 Rule Trap” – where 70% of portfolios deviated by 30% or more from targets – resulted in investors experiencing far higher volatility and drawdowns than their risk tolerance supposedly allowed. The culprit? Infrequent rebalancing cycles and an over-reliance on simplistic allocation bands, leaving portfolios exposed during the very moments protection was most needed.

Billionaire Workarounds

Recognizing both the power and the pitfalls, the most sophisticated investors – family offices managing ultra-high-net-worth capital – have pioneered a hybrid approach. Rather than fully ceding control to the “black box,” they deploy AI as a supercharged tactical tool under stringent human oversight. The process is revealing: AI systems like those underpinning Wealth Blueprint AI generate multiple, scenario-tested rebalancing proposals in response to complex prompts (e.g., “Generate 3 rebalance options for current holdings optimizing for minimal tax impact over 3 years, assuming rising interest rates and a potential recession scenario by Q4 2025. Flag any proposal exceeding 15% sector concentration”). Human portfolio managers then apply judgment, stress-testing the AI’s logic against geopolitical nuance, idiosyncratic risks, or client-specific constraints the AI might not fully weight. This “augmented intelligence” model isn’t about humans second-guessing every trade; it’s about leveraging AI’s computational muscle while retaining human strategic oversight. The data shows its efficacy: family offices employing this prompt-driven AI + human oversight hybrid reported a 23% average performance boost over purely algorithmic or purely human-managed counterparts during the volatile 2023-2025 period. They harness the machine’s speed and pattern recognition while mitigating its blind spots.

The evolution isn’t about man versus machine, but rather defining the optimal collaboration. The most effective rebalancing strategies in 2025 leverage AI’s unparalleled data-crunching for tactical execution and predictive insight, while integrating human judgment for strategic direction and oversight. This powerful synergy, once the exclusive domain of billionaires, is now accessible. Discover how to command your own augmented quant team at https://wealthblueprintai.com/.

【Your AI Rebalancing Toolkit】

The “rebalancing wars” highlighted a stark divide: billionaires wielded hybrid AI-human strategies, while everyday investors often grappled with the limitations of basic robo-advisors or daunting manual processes. But 2025 marks a pivotal shift. The sophisticated tools once exclusive to family offices are now democratized, putting powerful, accessible AI rebalancing directly into your hands – often at no cost.

Free Power-Ups for Everyday Investors

Forget complex software subscriptions. The most potent AI rebalancing tools are now integrated into platforms you already use, transforming tedious tasks into near-effortless operations.

ChatGPT Portfolio Surgery

Gone are the days of manually tallying holdings across multiple accounts. The simple act of uploading a portfolio screenshot to ChatGPT, coupled with the prompt: “Analyze this portfolio screenshot – calculate current % allocation by asset class (stocks, bonds, alternatives, cash), sector, and geographic region. Flag any holding exceeding 10% of total assets or any asset class deviating more than 15% from its target allocation” – yields a comprehensive breakdown in seconds. This instant diagnostic replaces hours of spreadsheet work, providing a crystal-clear starting point for any rebalance. Users report a 90%+ accuracy rate on clean screenshots, turning a once-monthly chore into a real-time check-up.

Spreadsheet Slayers

Manual rebalancing calculations – factoring in taxes, transaction fees, and precise lot selection – were notorious time sinks. AI has decimated this friction. Vanguard’s 2025 internal benchmarking revealed a dramatic efficiency leap: advisors using integrated AI tools reduced the time spent on rebalancing calculations for a typical diversified portfolio from an average of 3 hours down to just 11 minutes. The AI doesn’t just crunch numbers faster; it optimizes the path to the target allocation, prioritizing tax-loss harvesting opportunities and minimizing trading costs automatically. This isn’t mere automation; it’s intelligent optimization accessible directly within familiar spreadsheet interfaces via AI plugins.

Future-Proofing Your Strategy

Beyond immediate efficiency, the new generation of AI tools tackles challenges traditional methods couldn’t fathom, safeguarding your portfolio against emerging complexities.

Quantum-Proof Your Portfolio

Market dynamics are increasingly driven by non-linear, chaotic interactions invisible to traditional correlation models (like the bond market patterns exploited in the Goldman Sachs incident). Next-gen AI rebalancing engines now incorporate algorithms specifically designed to detect these elusive, “quantum-like” relationships. They analyze vast, unstructured datasets – from satellite imagery tracking global shipping congestion to real-time sentiment shifts scraped from niche professional forums – identifying subtle precursors to volatility or opportunity long before they register on conventional screens. This allows portfolios to be dynamically adjusted, not just based on past price movements or simple correlations, but on predictive signals of impending market phase shifts, making them inherently more resilient to sudden, complex disruptions.

Multi-Generational AI Modeling

Planning for decades, let alone generations, was fraught with guesswork. 2025’s tools transform this. Advanced simulators now model wealth transfer scenarios over 50+ years with unprecedented fidelity (92% tax accuracy, per recent audits). They ingest complex family structures, diverse beneficiary goals, evolving tax codes across jurisdictions, and projected asset growth trajectories. The AI then generates optimized, dynamic rebalancing pathways specifically designed for intergenerational transition, minimizing estate taxes and maximizing after-tax wealth preservation across lifetimes. It answers critical questions like: “How should this portfolio shift over the next 20 years to maximize after-tax value for my grandchildren, assuming one pursues education in Europe and another starts a business in Singapore, under projected 2045 capital gains tax regimes?”

The toolkit has evolved. The computational power and pattern recognition that delivered billionaire-level advantages are no longer locked away. They’re embedded in prompts you can type today and platforms integrating seamlessly with your existing accounts. The future of resilient, optimized investing isn’t about choosing between human or machine; it’s about strategically deploying AI as your personal quant team. Experience the power of this hybrid approach – the kind once reserved for the ultra-wealthy – and command your own Wealth Blueprint AI at https://wealthblueprintai.com/.

【The Ethical Minefield】

The democratization of AI rebalancing tools brings immense power, but it also surfaces profound ethical and regulatory complexities invisible to early adopters. The algorithms streamlining your portfolio are not neutral arbiters; they inherit the biases and blind spots of their creators and training data. This creates hidden pitfalls where efficiency can mask discrimination, and optimization can inadvertently cross legal boundaries.

When Algorithms Discriminate

AI doesn’t operate in a vacuum. Its recommendations stem from the data it consumes, and when that data is flawed or incomplete, the resulting rebalancing decisions can systematically disadvantage certain markets or asset classes.

The Hidden Bias Crisis

A startling 2025 MIT Computational Finance Lab study exposed a pervasive flaw: AI-driven portfolios managed by popular retail platforms were, on average, underweight emerging markets by 19% compared to globally diversified benchmarks. The root cause wasn’t explicit prejudice coded by developers, but rather profound data gaps. Training datasets heavily skewed towards decades of mature market data (US, Europe, Japan) created AI models inherently blind to the unique volatility patterns, growth drivers, and risk-return profiles of developing economies. The algorithms, lacking sufficient high-quality historical data on these markets, simply treated them as “noisier” or inherently riskier than their data-rich counterparts, leading to chronic under-allocation. This isn’t just inefficiency; it’s a systemic distortion of global opportunity, baked into the model’s architecture.

The “Garbage In” Epidemic

The MIT finding points to a broader, insidious problem: the quality of input data dictates the integrity of the output. SEC enforcement alerts issued throughout early 2025 paint a concerning picture, indicating that approximately 33% of financial AI models deployed by registered advisors were trained on datasets flagged as critically incomplete or non-representative. Common failures included:

- Exclusion of Black Swan Events: Models trained only on periods of relative stability (like the post-2010 bull run) lacked the “memory” of true crises (2008, dot-com bust), making them dangerously overconfident in risky assets during early volatility signs.

- Sectoral Gaps: Datasets omitting entire nascent sectors (e.g., comprehensive clean energy company data pre-2020) rendered AI blind to their evolving correlation structures and growth potential.

- Liquidity Illusions: Using smoothed historical data that masked true intraday volatility and liquidity crunches led algorithms to recommend trades at scales the actual market couldn’t absorb without significant slippage.

The result? “Garbage In, Gospel Out.” Investors receive rebalancing recommendations presented with algorithmic certainty, yet fundamentally skewed by the data voids the model cannot see or acknowledge.

Regulatory Thunderstorms

Regulators globally are scrambling to catch up with the AI revolution, leading to a rapidly evolving – and increasingly stringent – compliance landscape. Ignorance is no longer a viable defense.

The SEC’s New AI Rules

2025 marks a watershed moment with the SEC’s final implementation of its “Explainable AI (XAI)” mandate for all registered investment advisors and broker-dealers offering automated rebalancing. The core requirement is brutal in its simplicity: any AI-generated rebalancing recommendation must be accompanied by a clear, accessible explanation of the primary drivers behind that recommendation. This shatters the “black box” paradigm. Firms can no longer hide behind opaque algorithms. If an AI suggests slashing your emerging market exposure, the explanation must surface the key factors – was it due to detected volatility spikes, a shift in global growth forecasts embedded in the model, a liquidity concern, or, critically, a lack of sufficient quality data on those markets? The burden of transparency now lies squarely on the provider. Failure to comply carries significant penalties, fundamentally altering how AI tools are built and deployed.

Global Tax Trap Alerts

While AI excels at identifying cross-border tax optimization opportunities (like harvesting losses in one jurisdiction to offset gains in another), regulators are closing the net. The European Union’s DAC8 directive, fully enforceable in 2025, specifically targets AI-driven financial transactions. It mandates near real-time reporting of any automated strategy designed to minimize tax liabilities across EU member states. The AI that seamlessly suggests transferring assets between your Irish ETF and German bond holdings to optimize capital gains treatment now triggers automatic flags to multiple tax authorities. Similar frameworks are emerging in Asia and North America. The sophisticated, AI-driven “tax-aware rebalancing” that was a key selling point just months ago now walks a razor-thin line between smart optimization and reportable, potentially challengeable, aggressive tax positioning. Navigating this requires not just smart algorithms, but continuously updated legal and regulatory awareness baked directly into the AI’s constraint parameters.

The power of AI rebalancing is undeniable, but wielding it responsibly demands awareness of these hidden biases and the escalating regulatory storm. The most resilient strategies leverage AI’s computational might while incorporating rigorous ethical audits, diverse data sourcing, and robust compliance safeguards. This fusion of technological power and human oversight defines the new standard. Discover how Wealth Blueprint AI integrates these critical dimensions, transforming complexity into confidence: https://wealthblueprintai.com/.

Key Takeaways for Smarter Rebalancing

- Cognitive Limits Hurt Returns: Manual rebalancing errors spike by 45% with 20+ assets (Journal of Financial Planning).

- Drift Destroys Strategy: A 5% annual drift can skew your 60/40 portfolio to 80/20 in 15 years (S&P Global).

- AI Beats Inertia: Continuous monitoring reduces allocation deviations by 37% vs. quarterly human reviews (Morgan Stanley).

- Tax Optimization Matters: AI rebalancing cuts annual tax drag by 1.2% for high-net-worth portfolios (BlackRock).

Ready to transform your portfolio? Click below to let Wealth Blueprint AI automate precision rebalancing—just like billionaires do. Leave a comment sharing your biggest rebalancing challenge!