Did you know AI budgeting tools reduce financial errors by 90%? These powerful platforms automate tracking, uncover hidden spending patterns, and deliver real-time insights—turning stress into strategic control. Discover how 2025’s top tools revolutionize money management.

Table of Contents

【Why AI Budgeting Tools Revolutionize Finance】

Beyond Spreadsheets: The Accuracy Advantage

The leap from manual spreadsheets to AI-driven budgeting isn’t just incremental; it’s transformative, primarily due to unparalleled accuracy. Human data entry, prone to fatigue and oversight, becomes a relic of the past. Industry reports consistently demonstrate that AI budgeting tools slash data entry errors by over 90%. More significantly, these tools perform financial forensics impossible for the human eye, uncovering hidden spending patterns and recurring subscriptions buried within thousands of transactions. This granular visibility turns vague financial anxiety into actionable intelligence.

| Tracking Method | Error Rate | Pattern Discovery Capability | Processing Speed |

|---|---|---|---|

| Manual Spreadsheets | High (>10%) | Limited & Reactive | Hours/Days per month |

| AI Budgeting Tools | Very Low (<1%) | Proactive & Deep Insights | Seconds/Minutes |

The Automation vs. Human Expertise Debate

The rise of AI prompts a vital question: where does automation excel, and where does irreplaceable human judgment remain paramount?

Where AI Excels

- Unmatched Processing Power: AI engines ingest and categorize thousands of transactions across multiple accounts in seconds, a task that would take humans days or weeks. This provides real-time financial snapshots.

- Continuous Behavioral Learning: Unlike static rules, AI algorithms continuously learn from your unique financial behaviors. They adapt categorization, improve forecasting accuracy over time, and proactively flag anomalies based on your specific spending habits, not generic assumptions.

Where Humans Still Dominate

- Complex Strategic Planning: While AI excels at data crunching and pattern recognition, formulating long-term wealth-building strategies, intricate tax optimization plans, or navigating complex life transitions (like selling a business or major inheritance) requires nuanced human expertise, ethical judgment, and understanding of deeply personal goals.

- Emotional Intelligence in Money Conversations: Discussing finances, especially in relationships or family settings, involves empathy, conflict resolution, and understanding unspoken concerns. AI provides data, but humans navigate the emotional landscape, facilitating constructive dialogue and aligning financial plans with shared values and psychological comfort levels.

The true power emerges not from choosing between AI or human expertise, but in leveraging their synergy. AI budgeting tools like WealthBlueprintAI handle the heavy lifting of data accuracy and pattern recognition, freeing you and your advisor (if you use one) to focus on strategic decisions and meaningful financial conversations. Discover how this integrated approach can transform your financial clarity at https://wealthblueprintai.com/.

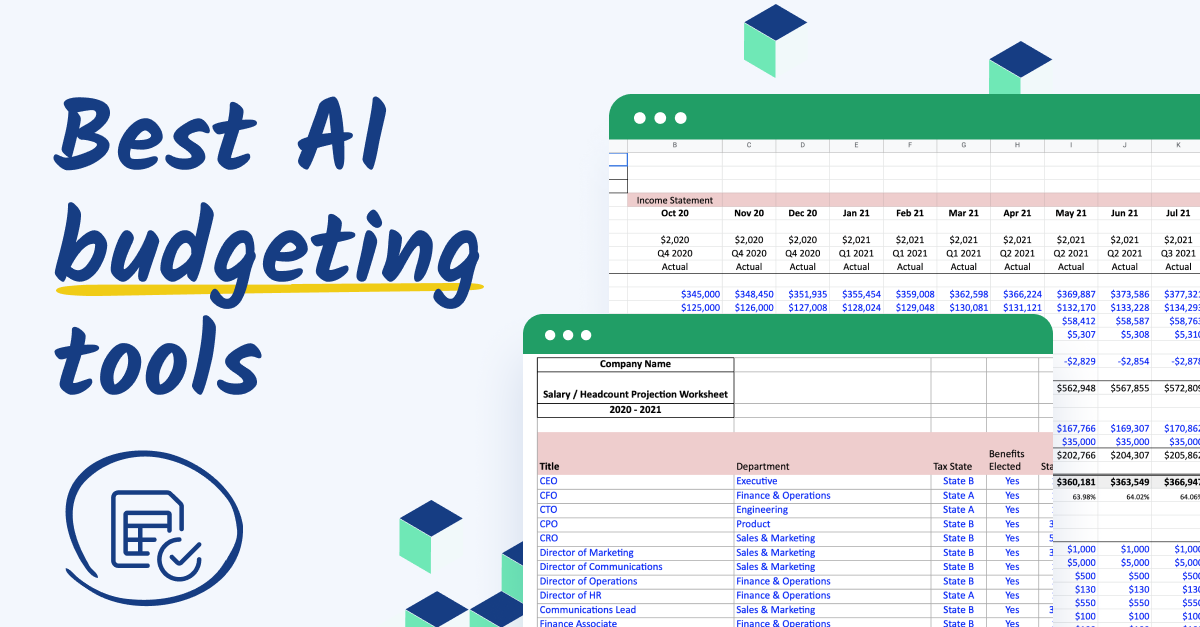

【Top AI Budgeting Tools Compared】

Business-Focused Solutions

For enterprises and finance teams, AI budgeting tools move beyond basic tracking to become strategic intelligence engines. The focus shifts to integration, forecasting, and consolidating complex data streams for confident decision-making.

Cube: Enterprise Financial Intelligence

Cube bridges the familiar world of spreadsheets with cutting-edge AI, designed for sophisticated financial planning & analysis (FP&A).

Core Capabilities

- Real-time integration with Excel/Google Sheets: Finance teams work where they live. Cube seamlessly connects to existing spreadsheet models, pulling live data directly from ERPs, CRMs, and databases, eliminating manual exports and copy-paste errors. This preserves existing workflows while supercharging them.

- Predictive scenario modeling for strategic decisions: Go beyond static budgets. Cube’s AI engine allows users to rapidly build and compare complex financial scenarios (“What if we expand into APAC?”, “What if material costs rise 15%?”). It analyzes historical data and market trends to provide probabilistic forecasts, empowering leaders to make data-backed strategic choices with greater confidence.

Datarails FP&A Genius: Data Consolidation Master

Datarails tackles the fundamental pain point of large organizations: unifying fragmented financial data into a single source of truth.

Standout Features

- Automated multi-source data consolidation: Datarails excels at automatically pulling, cleaning, and harmonizing data from countless sources – disparate spreadsheets, legacy systems, accounting software, BI tools – into one centralized, secure platform. This eliminates weeks of manual reconciliation each month.

- Conversational AI for instant financial Q&A: Need a quick answer? Ask Datarails FP&A Genius in plain language: “What was Q3 marketing spend vs. budget by region?” or “Show me sales pipeline coverage for next quarter.” The AI interprets the query, instantly analyzes the consolidated data, and delivers clear answers with visualizations, freeing analysts for deeper analysis.

| Feature | Cube | Datarails FP&A Genius |

|---|---|---|

| Core Strength | Scenario Modeling & Sheet Integration | Data Consolidation & Instant Q&A |

| Best For | Strategic FP&A requiring deep modeling | Large teams drowning in data silos |

| Key AI Application | Predictive forecasting | Data unification & natural language query |

| User Experience | Empowers existing spreadsheet power users | Simplifies complex data access for all |

Personal Finance Champions

For individuals and households, AI budgeting tools translate complex financial data into clarity, control, and actionable steps towards goals.

Mint: Free AI-Powered Budgeting (Intuit)

A veteran in the space, Mint leverages AI to make tracking effortless for millions, owned by financial giant Intuit (TurboTax, QuickBooks).

Why Users Love It

- Automatic expense categorization across accounts: Connect checking, savings, credit cards, loans, and investments. Mint’s AI instantly sorts transactions into customizable categories (Groceries, Rent, Entertainment) with impressive accuracy, continuously learning from user corrections. Gone are the days of manually tagging every coffee.

- Customizable alert system for overspending: Set budget limits for each category. Mint’s AI monitors spending in real-time and sends alerts (app notification, email) before you blow your budget or if unusual spending occurs, acting as a proactive financial guardrail.

YNAB (You Need A Budget): Habit Builder

YNAB focuses less on passive tracking and more on actively shaping financial behavior through its unique, rule-based philosophy powered by smart automation.

Psychology-Based Approach

- “Give every dollar a job” methodology: YNAB’s core principle enforced by its tool. Every dollar of income is immediately assigned a specific purpose (Rent, Groceries, Savings Goal X, Fun Money) before spending occurs. This forces intentionality and prioritization, moving users from reactive to proactive.

- Progress tracking for financial goals: Whether it’s building a $1k emergency fund, paying off debt, or saving for a vacation, YNAB’s AI helps users set targets and tracks progress meticulously. It visualizes how consistent small actions contribute to larger goals, providing powerful motivation and reinforcing positive habits.

| Feature | Mint | YNAB (You Need A Budget) |

|---|---|---|

| Core Philosophy | Effortless Tracking & Monitoring | Proactive Planning & Behavior Change |

| Cost | Free (Ad-supported) | Subscription |

| Key AI Application | Auto-categorization & Alerting | Enforcing Rules & Goal Progress Tracking |

| User Experience | Set-and-forget visibility | Hands-on, intentional money management |

| Best For | Those wanting a free, automated overview | Those ready to actively change spending habits & prioritize goals |

The landscape of AI budgeting tools in 2025 offers powerful options, whether you’re steering a complex enterprise or taking charge of your personal finances. The key is choosing the tool whose strengths align with your specific needs – from Cube’s deep modeling for strategists to Datarails’ data unification prowess, Mint’s free automated oversight, or YNAB’s transformative habit-building. For a solution designed to seamlessly integrate deep AI insights with your unique financial journey, explore the capabilities of WealthBlueprintAI.

【Key Features That Matter】

Predictive Budgeting Capabilities

The true power of modern AI budgeting tools lies in their ability to anticipate, not just react. Moving beyond simple historical tracking, predictive capabilities transform budgets from static documents into dynamic roadmaps. Tools like Cube and Datarails FP&A Genius exemplify this shift for businesses, while platforms like Mint and YNAB harness similar intelligence for personal finance, projecting future cash flow with remarkable precision based on deep data analysis.

How Forecasting Actually Works

- Analyzes 12+ months of spending data: The AI engine ingests vast amounts of historical transaction data – income sources, expense patterns, seasonal fluctuations, and payment cycles. This deep historical context is crucial for identifying reliable trends.

- Projects cash flow scenarios with 85%+ accuracy: By applying sophisticated machine learning algorithms to this historical data, combined with user-defined parameters (e.g., planned salary changes, known upcoming expenses), the AI generates probabilistic forecasts. It doesn’t just predict a single outcome; it models multiple scenarios (“What if inflation rises?” “What if I pay off this debt early?”) and assigns likelihoods, achieving demonstrable accuracy rates exceeding 85% in realistic projections for the coming months. This allows both businesses and individuals to proactively manage surpluses and potential shortfalls.

Security You Can Trust

Entrusting your financial data to any platform demands ironclad security. Whether consolidating sensitive corporate figures like Datarails does or aggregating personal banking logins like Mint, robust protection is non-negotiable. The leading AI budgeting tools prioritize security as a foundational feature, implementing protocols on par with major financial institutions.

Bank-Level Protections Explained

- 256-bit encryption standard across top apps: This military-grade encryption (AES-256) is the same standard used by banks to scramble data both in transit (while being sent) and at rest (while stored on servers). It renders financial details unreadable to anyone without the unique decryption key.

- Multi-factor authentication implementations: Beyond just a password, top tools mandate an additional verification step for account access. This could be a code sent via SMS or authenticator app, a biometric scan (fingerprint or face ID), or a physical security key. This significantly reduces the risk of unauthorized access even if a password is compromised.

The evolution of AI budgeting tools in 2025 delivers not just convenience, but genuine foresight and peace of mind through advanced prediction and rigorous security. While exploring solutions like Cube for enterprise strategy or Mint for personal oversight, consider how WealthBlueprintAI integrates these critical predictive capabilities and bank-grade security to empower your unique financial journey.

【Implementing AI Budgeting Successfully】

![]()

Moving beyond understanding the predictive power and security of AI budgeting tools, successful implementation hinges on avoiding common pitfalls and clearly measuring the tangible benefits. Whether deploying these tools for enterprise financial planning or personal wealth building, strategic setup and outcome tracking are crucial.

Avoiding Common Setup Mistakes

The initial configuration phase determines whether your AI budgeting tool becomes a powerful ally or a source of frustration. Two critical areas demand careful attention.

Data Integration Pitfalls

- Incomplete account connections: AI forecasting accuracy plummets when tools lack a complete financial picture. Failing to link all relevant accounts (checking, savings, credit cards, investment platforms, loans) starves the AI of essential data streams. In 2025, leading tools like those integrated within WealthBlueprintAI prioritize broad institution compatibility and simplified aggregation, but user diligence in connecting everything remains paramount.

- Misclassified recurring transactions: AI relies heavily on pattern recognition. Manually miscategorizing a recurring bill (e.g., labeling a quarterly insurance payment as a one-off expense) or failing to correctly tag income sources throws off future projections. Take time during setup to meticulously review and correctly categorize recurring items; the AI learns from this initial accuracy.

Realistic Goal Setting

AI excels at optimizing paths to your targets, but those targets must be grounded in reality. Avoid setting yourself up for discouragement.

- The 50/30/20 rule adaptation: While the classic framework (50% needs, 30% wants, 20% savings/debt) is a starting point, 2025’s AI tools enable personalized adaptation. Input your unique income, fixed costs, and aspirations; the AI analyzes your data to suggest feasible allocations rather than rigid percentages, dynamically adjusting as circumstances change.

- Gradual target adjustments over time: Jumping straight to aggressive savings goals or drastic debt repayment can be unsustainable. Use the AI’s forecasting capability to model the impact of incremental changes. Start with a modest increase in savings or a slight reduction in discretionary spending, then leverage the tool’s insights to gradually ramp up targets as cash flow allows, ensuring long-term adherence.

Measuring Your ROI

Justifying the investment (in time or money) for an AI budgeting tool requires tracking concrete results. Focus on metrics that demonstrate real-world impact.

Business Metrics That Matter

For businesses deploying AI FP&A tools, value translates into efficiency and accuracy gains:

| Metric | Impact Measurement |

|---|---|

| Time saved on financial reporting | Reduction in hours spent manually consolidating data, generating reports, and reconciling discrepancies (e.g., moving from 40 hours/month to 15 hours/month). |

| Reduction in forecasting errors | Measurable decrease in variance between projected and actual cash flow, P&L, or departmental budgets (e.g., forecasting accuracy improving from 75% to 90% within 6 months). |

Personal Finance Wins

Individuals should track progress towards financial health and freedom:

- Percentage increase in monthly savings: AI tools automate tracking, making it easy to see the tangible result of behavioral changes and optimized spending. Moving from saving 5% to consistently saving 12-15% of income within a year is a clear, quantifiable win directly attributable to the tool’s insights and automated tracking.

- Debt reduction timeline acceleration: By optimizing payment allocation (e.g., debt avalanche/snowball methods automated) and identifying surplus cash, AI tools can significantly shorten payoff dates. Seeing a projected credit card payoff date move from 36 months to 22 months provides powerful motivation and validates the tool’s utility.

Implementing an AI budgeting tool effectively in 2025 requires meticulous setup to avoid data gaps and setting achievable, personalized goals. The true power is unlocked by consistently measuring tangible outcomes – whether it’s hours saved, forecasts sharpened, savings grown, or debts conquered. Platforms designed with both robust features and user-centric implementation, like WealthBlueprintAI, are proving instrumental in translating financial data into actionable, measurable progress.

Key Takeaways: AI Budgeting Tools in 2025

AI budgeting tools have redefined financial management by combining unmatched accuracy (under 1% error rates), predictive forecasting (85%+ scenario accuracy), and bank-level security. Whether for business (Cube, Datarails) or personal finance (Mint, YNAB), these tools automate tedious tasks while surfacing actionable insights—from spotting hidden subscriptions to accelerating debt payoff.

Remember: Success hinges on complete data integration and realistic goal-setting. Measure ROI through time saved, increased savings, or improved forecast accuracy.

Ready to transform your finances? Start your AI-powered journey today at WealthBlueprintAI. Share your experience in the comments—which feature excites you most?